What is a Payment Gateway? How to Safely Accept Global Payments!

In Hong Kong, a hub for international trade and e-commerce, accepting global payments has become critical for businesses expanding into overseas markets. As a bridge connecting merchants and customers, payment gateways not only impact transaction success rates but also directly affect fund security and customer experience. Want to take your business global? This article provides a comprehensive guide on choosing a reliable payment gateway to safely and efficiently accept global payments, helping you seize international business opportunities!

Payment Gateway: Accept Global Payments Need to Know

A payment gateway is a technological intermediary platform responsible for securely transmitting and processing payment information between customers, merchants, banks, and payment processors. It acts like a "digital cash register," ensuring that transaction data is encrypted, authorized, verified, and settled smoothly.

Payment Gateway Technology and System Integration

How to Choose a Payment Gateway for Global Business?

Selecting a payment gateway requires considering multiple factors to ensure it meets global business needs and supports accepting global payments.

- Supported Currencies and Countries: Ensure the gateway supports multiple currencies (e.g., USD, EUR, CNY) and covers target markets (e.g., the US, EU, Southeast Asia).

- Fees: Compare per-transaction percentage fees and fixed fees to choose a cost-effective platform.

- API Stability: A stable API ensures seamless integration with e-commerce platforms, reducing technical issues.

- User Experience: A simple payment process with multi-language support and mobile-friendliness enhances customer satisfaction.

Hong Kong merchants often choose payment gateways due to their extensive currency support and stable APIs, ideal for accepting global payments.

How Difficult is Payment Gateway Integration?

The integration difficulty of a payment gateway depends on the platform’s technical requirements and the merchant’s capabilities. Common scenarios include:

- Simple Integration: Some payment gateways offer pre-built plugins, suitable for SMEs without development experience, requiring no professional team for setup.

- Advanced Integration: Some gateways’ APIs require developer support, ideal for large enterprises with technical teams to implement customized payment flows.

- Multi-Language and Multi-Currency: Most mainstream gateways support multi-language payment pages and dynamic currency conversion, facilitating global customer use.

Hong Kong businesses can choose gateways based on their technical capabilities, with SMEs prioritizing user-friendly platforms to quickly accept global payments.

How to Handle Multi-Currency and Exchange Rate Issues?

Multi-currency processing is a core challenge in accepting global payments. Solutions include:

- Real-Time Exchange Rate Conversion: Integrate exchange rate APIs to display real-time rates, ensuring price transparency.

- Exchange Rate Locking: Some payment gateways offer rate-locking features, allowing merchants to settle at a fixed rate to reduce fluctuation risks.

- Multi-Currency Accounts: Opening multi-currency accounts to directly receive foreign currencies minimizes conversion frequency and fees.

Hong Kong merchants can leverage these tools to optimize multi-currency settlements, ensuring stable profits and enhanced customer payment experiences.

How to Handle Payment Failures and Exceptions?

Cross-border payments may fail due to card declines or network issues. Handling methods include:

- Automatic Retries: Automatically retry failed transactions to reduce cart abandonment rates.

- Notification Mechanisms: Payment gateways should provide instant failure notifications, prompting customers to check card details or switch payment methods.

- Transaction Reports: Use the gateway’s backend to track payment status and generate detailed reports to analyze failure causes.

These measures help improve transaction success rates, ensuring merchants can smoothly accept global payments.

Payment Methods and Localization

What Are the Mainstream Payment Methods in Different Markets?

Payment preferences vary significantly across countries and regions. To accept global payments, merchants should understand these mainstream methods:

- Credit/Debit Cards: Dominant in Western markets, supporting Visa and MasterCard, ideal for B2C e-commerce.

- Digital Wallets: Facilitate quick, small-value payments.

- Bank Transfers: Suitable for B2B large transactions.

- Local Payment Methods: Digital wallets, Octopus, and FPS meet specific market needs.

Hong Kong merchants should prioritize supported payment methods based on their target markets.

How to Optimize the Localized Payment Experience?

Localization is key to improving global payment acceptance rates. Critical measures include:

- Language and Currency: Support multi-language payment pages and local currency symbols to boost customer trust.

- Tax Rules: Automatically calculate VAT or GST and display it on the payment page to comply with local tax requirements.

- Local Verification: Support secure verification to ensure payment processes meet regional standards.

Hong Kong e-commerce businesses can choose gateways that offer dynamic localization to meet global market demands.

How to Prevent Cross-Border Payment Fraud?

Cross-border payments face fraud risks like card theft and fake transactions. Prevention measures include:

- AI Fraud Detection Tools: Integrate tools to detect abnormal transactions through behavioral analysis.

- Address Verification Service (AVS): Verify cardholder addresses against card details to reduce fraud risks.

- Card Verification Value (CVV) Check: Ensure the payer holds the actual card, minimizing fraud possibilities.

Hong Kong merchants can choose payment gateways with built-in AI fraud detection to ensure the security of accepting global payments.

Costs and Efficiency of Accepting Global Payments

How Are Payment Gateway Fees Calculated?

Payment gateway fee structures vary by platform, with common fees including:

- Percentage Fees: A fixed percentage is charged per transaction.

- Cross-Border Surcharges: Additional fees may apply to cross-border transactions.

- Fixed Fees: A fixed amount per transaction, depending on the platform.

Hong Kong merchants can compare fee structures to choose solutions that match their business scale.

How to Optimize Transaction Fee Costs?

Strategies to reduce transaction fees include:

- Batch Settlements: Consolidate multiple small transactions to reduce fixed fee occurrences.

- Low-Cost Channels: Prioritize local payment methods to lower fees.

- Negotiate Discounts: Large merchants can negotiate lower rates with payment gateways.

Hong Kong SMEs can choose cost-effective platforms to optimize the cost-efficiency of accepting global payments.

How to Manage Settlement Cycles and Cash Flow?

Payment gateway settlement cycles impact cash flow. Common scenarios include:

- Settlement Time: T+1 (next-day settlement) for local transactions, T+3 to T+7 for cross-border transactions.

- Accelerated Settlement: Enables instant fund receipt.

- Multi-Currency Management: Use multi-currency accounts to hold foreign currencies, reducing conversion losses.

Hong Kong merchants can select gateways with fast settlement options to enhance cash flow flexibility.

Is Accepting Global Payments Safe? How to Choose a Trustworthy Platform!

The safety of accepting global payments depends on the choice of payment gateway and compliance measures. Recommendations for selecting a reliable platform include:

- Regulatory Credentials: Ensure the platform complies with HKMA, PCI DSS, and international data protection regulations.

- Security Technologies: Choose platforms supporting 3D Secure, AVS, and data encryption.

- User Reviews: Refer to other merchants’ experiences to select reputable platforms.

Hong Kong merchants should prioritize gateways with strong localization support and transparent fees to safely and efficiently accept global payments.

All Your Questions About Accepting Global Payments Answered!

Here’s a summary of common questions:

- Is a Payment Gateway Necessary? For cross-border e-commerce, payment gateways are essential for accepting global payments, simplifying processes and enhancing security.

- How to Reduce Cart Abandonment? Optimize payment pages, support multiple payment methods, and offer localized experiences.

- How to Combat Fraud? Use AI fraud detection tools and AVS/CVV verification to minimize risks.

- Is a Technical Team Required? SMEs can choose user-friendly platforms without needing professional development support.

By selecting the right payment gateway, Hong Kong merchants can tackle global payment challenges and expand into international markets.

As a Fintech hub, Hong Kong is actively exploring these technologies to help merchants accept global payments more efficiently.

How Do AI and Automation Optimize Payment Processes?

AI and automation technologies offer the following benefits for payment gateways:

- Smart Routing: Automatically select the lowest-cost payment channel.

- Fraud Prediction: AI analyzes transaction patterns to detect anomalies in real-time, reducing fraud risks.

- Automated Reconciliation: Generate real-time financial reports to simplify multi-currency settlement management.

How Does Accepting Global Payments Help Expand Your Business?

Multi-currency settlements are critical for global business expansion. Practical suggestions include:

- Offer Local Currency Options: Display prices in customers’ local currencies to lower payment barriers.

- Reduce Conversion Losses: Use multi-currency accounts to hold foreign currencies directly, minimizing conversion fees.

- Lock Exchange Rates: Leverage payment gateways’ rate-locking features to stabilize profits.

Hong Kong merchants can use multi-currency solutions to streamline global payment management and expand their business reach.

Payment gateways are key to accepting global payments. Choosing a reliable platform requires balancing technical stability, compliance, security, and cost-effectiveness. In Hong Kong, merchants can leverage leading payment gateways and fintech innovations to safely and efficiently tap into international markets.

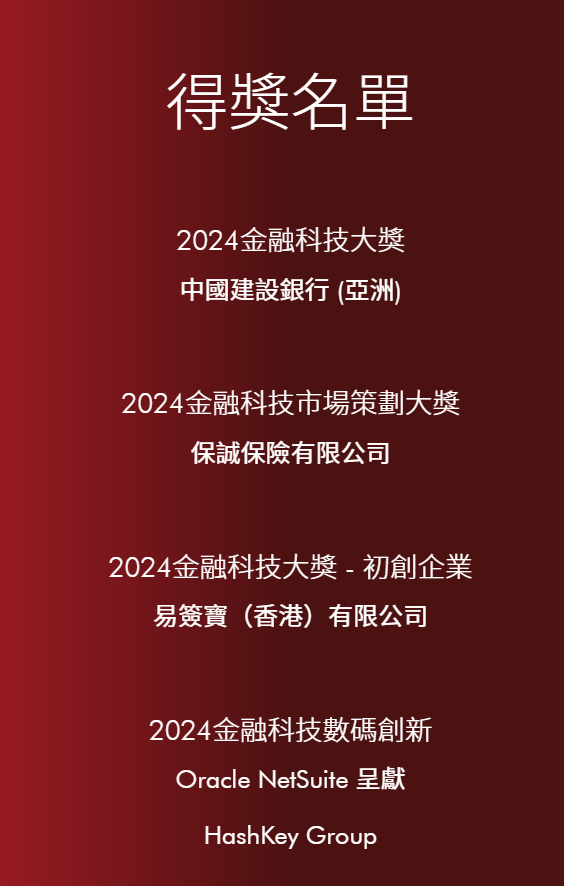

作為「金融科技發展獎」的獲獎單位,eSignGlobal深知科技創新對於金融業的重要性。自成立以來,eSignGlobal深耕電子簽名服務領域,致力於透過電子簽名技術,完成企業與企業的連接,從而建立完善的智慧商業信用體系。在香港,eSignGlobal已經服務了包括數碼港、中建國際、EFTpay等在內的200多位優質客戶。

出海已然成為大勢所趨。為賦能中國企業全球化之路,打造一個由中國主導的電子簽名體系,eSignGlobal在全球範圍內搭建了三大數據中心,並在中國香港設立了國際化業務總部,以便更好地適應不同國家的法律法規要求,為不同地區的客戶提供更加穩定、高效的服務,同時吸引更多的國際客戶,推動其全球電子簽名體系的建設。

eSignGlobal基於AI技術打造的智慧化電子簽名服務平台,根據不同國家和地區的法律要求,提供客製化的電子簽名服務。在合約簽署環節,eSignGlobal有效解決了跨國簽署效率低、合約管理困難、法律效力缺乏保障等問題,大幅提升跨國簽署及合約管理效率,輕鬆解決全球化簽約難題。

資料來源:東方財富網