e-Payments Development

e-Payment has developed at supersonic speed and has experienced extremely rapid growth. Payment habits globally are also changing. The e-Payment market is increasingly active. In some countries in Europe, entire cities have already gone cashless. You have in front of you a dizzying array of payment choices. How much do you know about them?

Top Payment Gateway HK-Secure & Efficient Payment Processing

Export eftPay's leading Payment Gateway HK solution for seamless and secure e-payment processing. Enhance your business transactions with our services.

Payment gateway hk: making online transactions easier

payment gateway hk is an indispensable part of e-commerce transactions. It serves as a bridge between merchants and banks to ensure the smooth progress of transactions. The main function of payment gateway hk is to process payment information and securely pass consumers' payment requests to the corresponding bank or payment processing institution. Payment gateway hk focuses more on the transmission and security of data compared to payment processors, which are responsible for handling the clearing and settlement of transactions. Payment service providers typically provide a range of services including payment gateways, including but not limited to payment processing, fraud detection and reporting, etc.

What are the main functions and operating mechanisms of payment gateways?

The core function of payment gateway hk is to securely process and forward payment information. When consumers select goods on the website and click to pay, payment gateway hk starts to work. It receives payment requests, including credit card information, payment amount and payer information, and then encrypts this information to ensure that it is not leaked or tampered with during the transmission process. . payment gateway hk sends this information to the payment processor via a secure network connection, which in turn passes the information to the appropriate bank for authorization and settlement. Once the transaction is completed, payment gateway hk returns confirmation information to the merchant and consumer.

What payment methods does the payment gateway support?

payment gateway hk supports a variety of payment methods to meet the needs of different consumers. This includes but is not limited to credit cards, debit cards, e-wallets, bank transfers, mobile payments, etc. With the development of payment technology, payment gateway hk is also constantly expanding the payment methods it supports, such as supporting cryptocurrency payments. In addition, payment gateway hk also supports multiple currencies, making cross-border transactions more convenient.

What is the security, integration, compatibility, and stability of the payment gateway?

1. Security

The security of payment gateway hk is one of its most important features. It uses the latest encryption technology to protect payment information and prevent data breaches and fraud.

2. Integration

In terms of integration, payment gateway hk can be easily integrated into various e-commerce platforms and shopping cart systems without complex technical knowledge.

3.Compatibility

In terms of compatibility, payment gateway hk supports multiple programming languages and development frameworks to ensure seamless integration with existing systems.

4. Stability

Stability is another key feature of payment gateway hk, which ensures transaction continuity through high availability and failover mechanisms to maintain service stability even in the event of high traffic or system failure.

What are the fees and charging models of payment gateways?

The fees and charging model of payment gateway hk vary depending on the service provider. Common charging models include fixed monthly fees, transaction fees and value-added service fees. A flat monthly fee is a fixed fee that merchants pay every month, regardless of transaction volume. Transaction fees are charged proportionally based on the amount of each transaction. Value-added service fees may include services such as advanced reporting, custom development and customer support. When merchants choose payment gateway HK, they should choose an appropriate charging model based on their business scale and needs.

Through the above analysis, we can see that payment gateway hk plays a vital role in e-commerce transactions. It not only provides secure and efficient payment processing services, but also provides great convenience to merchants and consumers by supporting multiple payment methods and currencies. With the continuous advancement of technology, we can foresee that payment gateway hk will play an even more important role in the future.

.More than 50 million merchant locations worldwide*

.Consumers around the world carry 3.3 billion Visa cards ^

*Source: Data provided to Visa by operating financial institutions and other third parties.

^Source: Figure is from Visa’s operational performance data and updated as of September 30, 2018.

In Hong Kong, more than half of face-to-face Visa transactions are contactless# . Visa users can tap and pay with contactless credit card, or enabled mobile devices such as smart phones and smart watches. Payment is simple, fast and secure.

#Source:Figure is from VisaNet and updated as of 31 March, 2019.

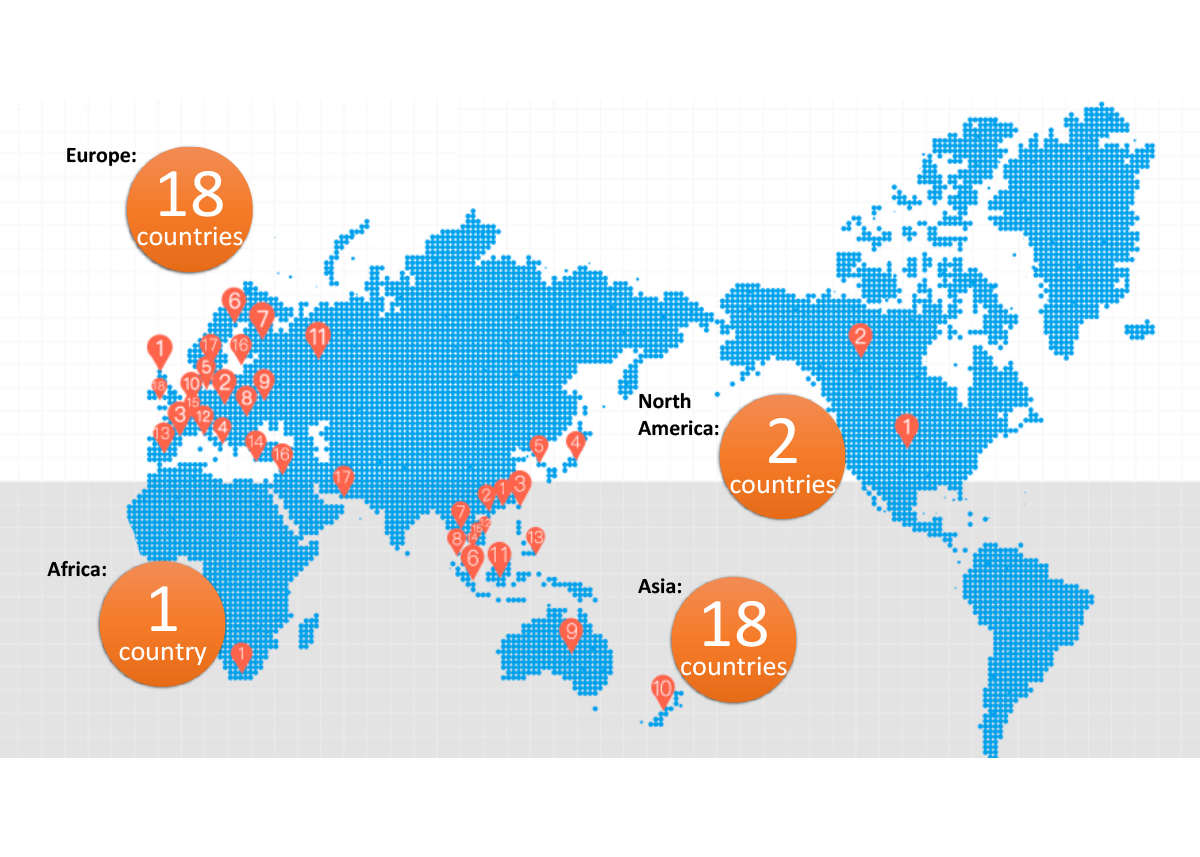

So far, users of the UnionPay app can enjoy safe and convenient mobile payment services in 47 countries and regions. UnionPay QR code payment is accepted at over 11 million merchants in mainland China, and is available in 31 countries and regions outside mainland China. The app users can also make tap&go payments at over 2.8 million POS terminals in 37 countries and regions.

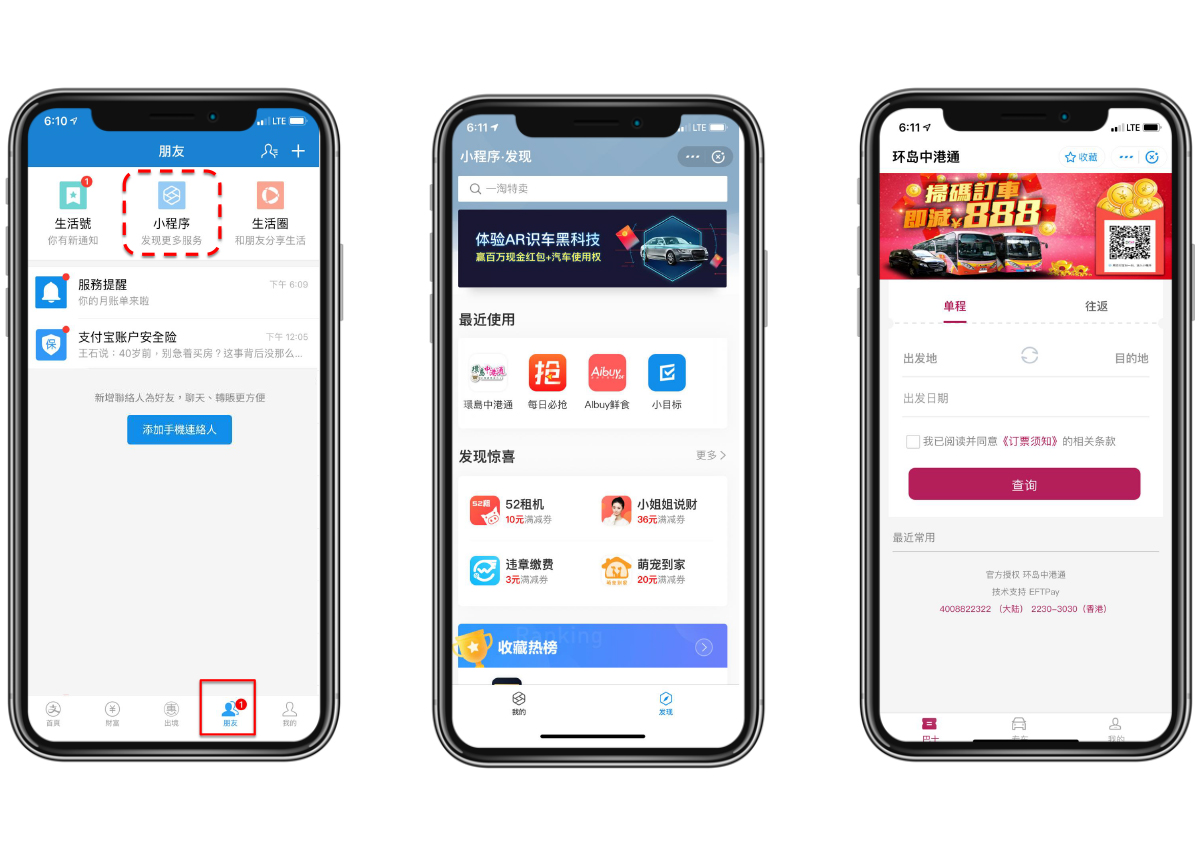

WeChat Pay

WeChat Pay is a leading third-party payment platform of Tencent Holdings Limited in China. ‘Not just Pay in WeChat Pay’ as their core value. WeChat Pay has always been devoted in providing users and enterprises secure, convenient, professional online payment services. ‘Smart living Solution’ seems WeChat Pay as a core and is now covering numerous industries, such as retailing, catering, medical, transportation, home affairs etc.. Not only does it provide exclusive daily conveniency for a billion active WeChat users, but also enhances the capability of sales for merchant, which causes a ‘cash-free’ live style, and builds a intelligent society.

Public account

WeChat public account is a service platform where provides merchants with exclusive business services and ability of user management. Merchant can recommend latest brand-related news and information. They can also invent booking system, customer service system, product introduction, positioning service etc. by establishing online shop which expand sales platform for merchants. They can have deeper interaction with customers in order to provide better service at the same while.